Coverage for biofeedback and neurofeedback varies widely depending on your insurance plan, provider, and the specific condition being treated. While some insurance policies do offer coverage for these therapies, others may label them as experimental or alternative, making reimbursement more difficult.

Let’s explore the details so you can better understand what to expect when it comes to getting these therapies covered by insurance.

Coverage Basics

Insurance coverage for biofeedback and neurofeedback can be a bit of a maze.

| Criteria | Details |

| Varies by Insurance Carrier and Plan | Coverage can differ greatly between insurance providers. Larger, more comprehensive plans may cover biofeedback and neurofeedback, while others might not. |

| Diagnosis Matters | Coverage often depends on the specific condition. For instance, biofeedback may be covered for chronic pain or migraines but not for general wellness. Neurofeedback may be covered for ADHD but not for anxiety. |

| Pre-authorization May Be Required | Coverage may require pre-authorization, meaning approval from your insurance provider before starting treatment. This typically involves a referral from your doctor. |

| CPT Codes | Specific CPT codes are used to bill for biofeedback and neurofeedback. For example, CPT code 90901 is for biofeedback training. Knowing these codes can help clarify coverage details with your insurer. |

How to Determine Coverage

1. Contact Your Insurance Company

Call the number on the back of your insurance card. Explain that you are seeking information about biofeedback or neurofeedback coverage. Ask directly if your plan covers these therapies. Make sure to specify the condition being treated, as this will often influence the answer.

According to Aspiring Families, thanks to FDA approval, some insurance companies are now providing reimbursement for neurofeedback sessions.

2. Verify CPT Codes

- 90901: Biofeedback training by any modality.

- 90875 and 90876: Biofeedback combined with psychotherapy.

Verify if any pre-authorization is required and under what conditions.

3. Get It in Writing

Request written confirmation of the coverage details discussed. This could be in the form of an email, a policy document, or even detailed notes from your conversation with the insurance representative.

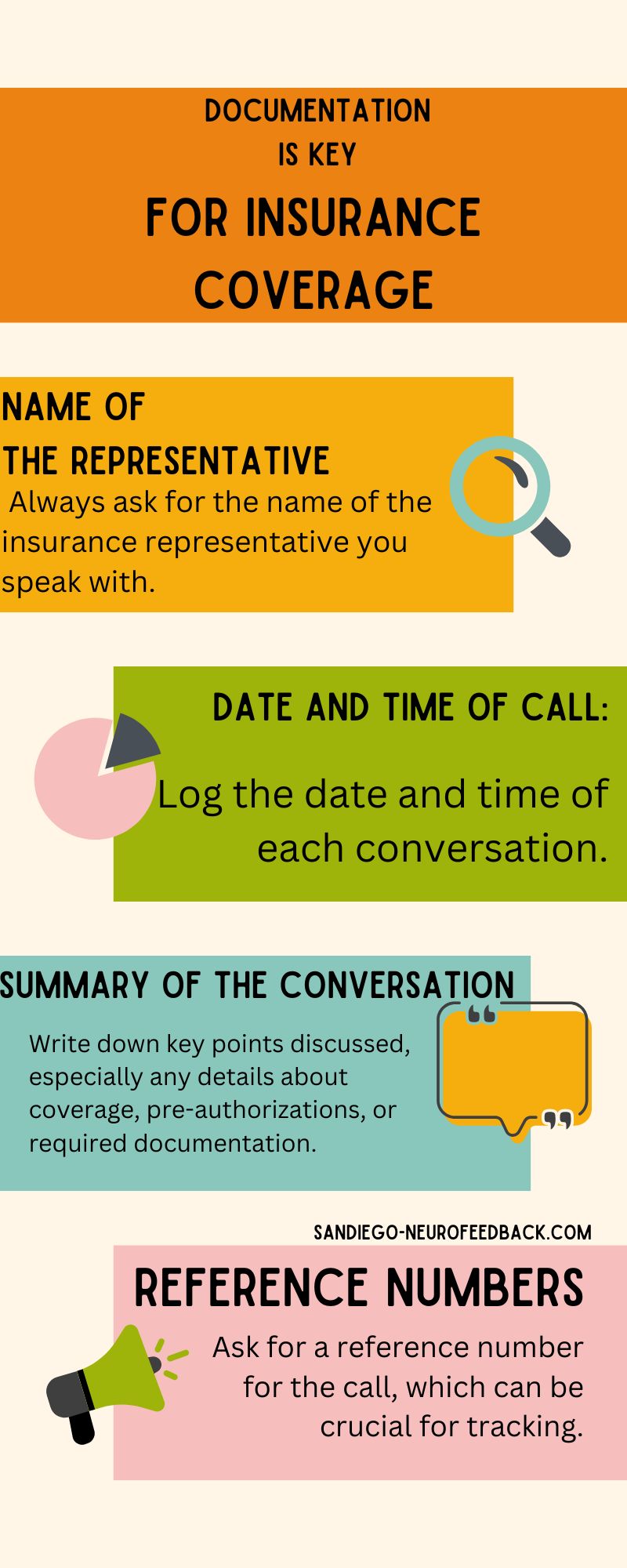

Documentation Is Key

- Name of the Representative: Always ask for the name of the insurance representative you speak with.

- Date and Time of Call: Log the date and time of each conversation.

- Summary of the Conversation: Write down key points discussed, especially any details about coverage, pre-authorizations, or required documentation.

- Reference Numbers: Ask for a reference number for the call, which can be crucial for tracking.

Keeping a detailed record of all your interactions with the insurance company helps protect you if there’s a disagreement about what was covered.

What If You’re Denied Coverage?

It’s not uncommon for initial claims to be denied. Here’s what you can do:

Request an Explanation

File an Appeal

Use the information you’ve documented to support your case. Include all records of communication, medical necessity documentation from your healthcare provider, and any supporting research that backs up the effectiveness of the treatment for your condition.

Get Support

Alternative Payment Options

If your insurance won’t cover biofeedback or neurofeedback, there are still ways to make it more affordable:

Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs)

Sliding Scale Fees

Some practitioners offer sliding scale fees based on your income or financial situation.

Clinical Trials or Research Studies

Occasionally, you may find research studies or clinical trials offering these therapies at a reduced cost or even for free.

Why Is Coverage So Varied?

You may also like: How Much Does Neurofeedback Cost? Factors That Affect the Cost

Conditions More Likely to Be Covered

Certain conditions are more likely to receive coverage for biofeedback and neurofeedback treatments. These may include:

- ADHD: Neurofeedback has shown promising results in managing ADHD symptoms, and some insurers may cover it when traditional treatments have not been effective.

- Chronic Pain: Biofeedback is often covered for chronic pain management, especially if it’s used as part of a broader pain management program.

- Migraine and Tension Headaches: Biofeedback has been found effective in reducing the frequency and severity of headaches, making it a potentially covered treatment.

Final Thoughts

The key to securing insurance coverage for biofeedback or neurofeedback is persistence, clear communication, and thorough documentation. Make sure to ask your insurance provider detailed questions about coverage, confirm which conditions and CPT codes are eligible, and document every conversation.